The 25th Edition of Fundamental Accounting Principles offers a comprehensive guide to accounting concepts, updated with modern standards and practices for enhanced learning experiences.

1.1 Overview of the 25th Edition

The 25th Edition of Fundamental Accounting Principles provides a comprehensive update to modern accounting standards and practices. Designed for both students and professionals, it offers in-depth coverage of financial reporting, ethical considerations, and emerging topics like technology’s role in accounting. The PDF edition enhances accessibility, featuring a searchable format and compatibility across devices, ensuring versatile learning and reference experiences.

1.2 Key Features of the 25th Edition

The 25th Edition of Fundamental Accounting Principles includes updated GAAP and IFRS standards, enhanced digital tools, and real-world examples; It features new chapters on advanced topics like ethical accounting and technology integration. The PDF edition offers enhanced search functionality, interactive exercises, and visual aids to improve comprehension. This edition is tailored for both students and professionals seeking a modern, practical approach to accounting education and application.

Structure and Organization of the Book

The 25th Edition is organized into logical chapters, each introducing key accounting concepts progressively. It includes detailed explanations, practical examples, and structured exercises to enhance understanding and application skills.

2.1 Chapter Breakdown and Content Coverage

The 25th Edition is divided into well-structured chapters, each focusing on specific accounting topics. Early chapters cover foundational concepts like GAAP and financial statements, while later chapters delve into advanced topics such as consolidated financial statements and ethical considerations. Each chapter builds on the previous one, ensuring a comprehensive understanding of accounting principles and their practical applications in real-world scenarios.

2.2 Learning Aids and Pedagogical Tools

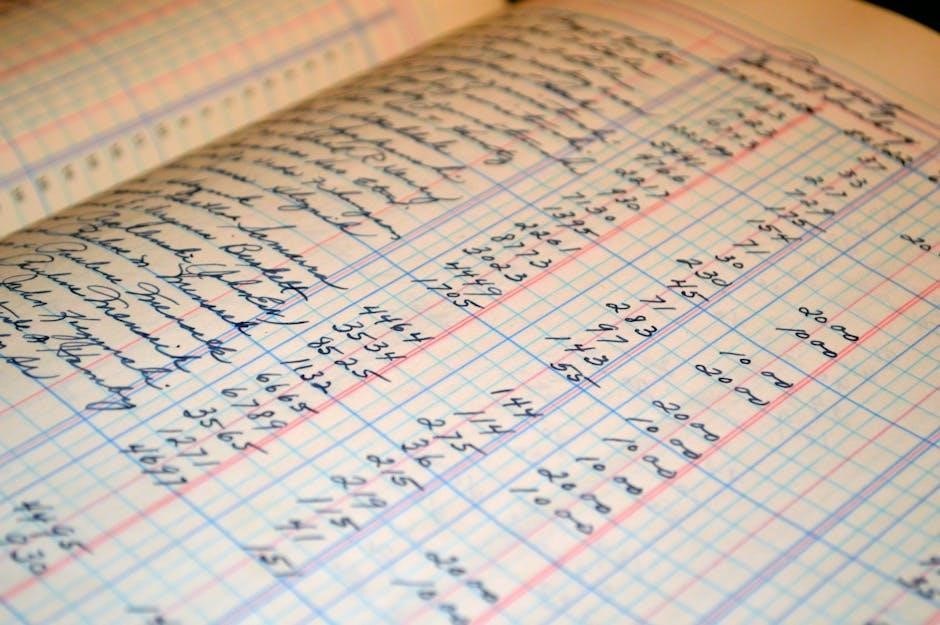

The 25th Edition incorporates various learning aids, such as practice exercises, chapter summaries, and self-assessment questions, to reinforce understanding. Visual elements like diagrams and color-coded financial statements enhance comprehension. Additional tools include real-world examples and ethical case studies, fostering critical thinking and practical application of accounting principles. These resources cater to diverse learning styles, ensuring a robust educational experience for students.

Key Accounting Principles and Concepts

This section explores foundational accounting principles, including GAAP and IFRS, emphasizing ethical practices and accurate financial reporting. It ensures transparency, consistency, and reliability in accounting processes globally.

3.1 Generally Accepted Accounting Principles (GAAP)

GAAP represents a framework of rules and standards guiding financial accounting in the U.S. It ensures consistency, transparency, and reliability in reporting. The 25th Edition details GAAP principles, such as revenue recognition, asset valuation, and expense matching, providing clear guidance for accurate financial statement preparation and compliance with regulatory requirements.

3.2 International Financial Reporting Standards (IFRS)

IFRS represents a global framework for financial reporting, fostering transparency and consistency across international markets; The 25th Edition explores IFRS principles, such as revenue recognition, lease accounting, and financial instrument reporting, enabling businesses to align with global standards. This section emphasizes the importance of IFRS in facilitating cross-border investments and comparisons, ensuring uniformity in financial reporting practices worldwide.

Financial Statements and Their Preparation

Financial statements, including the income statement, balance sheet, and cash flow statement, are essential for tracking a company’s financial performance and position, ensuring transparency and accountability.

4.1 Income Statement

The income statement, also known as the profit and loss statement, summarizes a company’s revenues and expenses over a specific period. It calculates net income by subtracting total costs from total revenues. This statement is crucial for assessing profitability and financial performance. It includes components like sales revenue, cost of goods sold, operating expenses, and non-operating items. The income statement provides insights into a company’s ability to generate profits and sustain operations effectively.

4.2 Balance Sheet

The balance sheet presents a company’s financial position at a specific point in time, detailing its assets, liabilities, and equity. It adheres to the accounting equation: Assets = Liabilities + Equity. This statement categorizes assets into current and non-current, and liabilities into current and long-term. It provides insights into a company’s liquidity, solvency, and financial stability, serving as a critical tool for stakeholders to assess financial health and make informed decisions.

4.3 Cash Flow Statement

The cash flow statement details a company’s cash inflows and outflows over a specific period. It categorizes activities into operating, investing, and financing. Operating activities relate to core business operations, while investing includes asset purchases or sales, and financing involves equity or debt changes. This statement provides insights into a company’s liquidity, cash management, and financial performance, aiding in assessing its ability to generate future cash flows and meet obligations effectively.

Specialized Topics in the 25th Edition

The 25th Edition delves into advanced accounting topics and ethical considerations, providing in-depth insights into complex financial scenarios and the importance of ethical practices in modern accounting.

5.1 Advanced Accounting Topics

The 25th Edition explores complex areas like consolidated financial statements, foreign currency transactions, and partnership accounting. It provides detailed guidance on advanced topics, ensuring students grasp intricate financial reporting requirements and global accounting standards. Practical examples and real-world applications enhance understanding, making it a valuable resource for those seeking expertise in advanced accounting practices and contemporary financial challenges.

5.2 Ethical Considerations in Accounting

The 25th Edition emphasizes the importance of ethical standards in accounting, highlighting professionalism and compliance with GAAP and IFRS. It underscores the role of honesty, transparency, and accountability in financial reporting. The text also explores ethical dilemmas and their implications, providing guidance on maintaining integrity in complex financial scenarios. Real-world case studies and exercises help students apply ethical principles in practical situations, fostering responsible decision-making in their future careers.

Benefits of the PDF Edition

The PDF edition of Fundamental Accounting Principles offers unparalleled accessibility, allowing users to study anytime, anywhere. It’s portable, easily accessible on multiple devices, and saves physical space effectively.

6.1 Accessibility and Convenience

The PDF edition of Fundamental Accounting Principles ensures ultimate flexibility and ease of use. It can be accessed on various devices like smartphones, tablets, and laptops, enabling study anywhere, anytime. The digital format eliminates the need for physical storage, reducing clutter and saving space. Users can also navigate seamlessly, with features like search functionality and bookmarking, making it ideal for quick reference and efficient learning on the go.

6.2 Enhanced Search and Navigation Features

The PDF edition boasts advanced search capabilities, allowing users to quickly locate specific topics or concepts within the text. Hyperlinks and cross-references enable seamless navigation between chapters and sections. Bookmarks and annotations features further enhance the learning experience, making it easier to organize and review material efficiently. These tools ensure a more interactive and productive study environment for students and professionals alike.

How to Access the 25th Edition PDF

To access the 25th Edition PDF of Fundamental Accounting Principles, visit the official publisher’s website or authorized online retailers like Amazon. Ensure you purchase from reputable sources to avoid unauthorized copies. Some educational institutions may offer access through their libraries. Always verify the edition and publication date before downloading to ensure you have the correct version.

7.1 Official Sources for Download

The 25th Edition PDF of Fundamental Accounting Principles is available through official sources like the publisher’s website, Amazon, and verified online retailers. Institutions may offer access via their libraries or e-learning platforms. Always verify authenticity by purchasing from trusted sellers to ensure quality and compliance with copyright laws. Avoid unofficial sites to prevent downloading unauthorized or outdated versions of the material.

7.2 Tips for Effective Study with the PDF

Maximizing the PDF edition of Fundamental Accounting Principles involves utilizing its search function for quick access to key terms and concepts. Highlighting and annotating important sections enhances retention. Organize notes by chapter and review summaries regularly. Use the index to navigate topics efficiently. Regular practice problems and self-assessment tools within the text ensure a deeper understanding of accounting principles and practical applications.

Common Questions About the 25th Edition

Common questions about the 25th Edition include its differences from previous versions and compatibility with online learning platforms. These queries address user adaptability and educational needs.

8.1 Differences from Previous Editions

The 25th Edition incorporates updated accounting standards, enhanced content on emerging topics like sustainability, and improved pedagogical tools; It also includes new chapters on technology’s role in accounting, offering a more comprehensive and modern approach compared to earlier editions. These updates ensure relevance to current educational and professional needs, making it a valuable resource for both students and instructors.

8.2 Compatibility with Online Platforms

The 25th Edition PDF is designed to be fully compatible with online learning platforms, ensuring seamless integration into digital classrooms. It supports interactive features, such as enhanced search and navigation, making it accessible on multiple devices. This compatibility allows students and instructors to use the material efficiently in various educational settings, promoting flexible and modern learning experiences.

User Reviews and Feedback

Students and instructors praise the 25th Edition for its clarity and comprehensive coverage. The PDF’s accessibility and readability on multiple devices enhance learning experiences.

9.1 Student Perspectives

Students have widely praised the 25th Edition for its clarity and comprehensive coverage of accounting principles. Many appreciate the PDF’s accessibility on multiple devices, enhancing their study flexibility. The color-coded financial statements and real-world examples are particularly highlighted as beneficial for understanding complex concepts. However, some students noted the dense content requires careful review, suggesting additional visual aids could further improve comprehension and engagement.

9.2 Instructor Feedback

Instructors praise the 25th Edition for its structured approach and updated content, which aligns well with modern accounting standards. The inclusion of real-world examples and pedagogical tools is particularly commended for fostering deeper understanding. Some instructors suggest additional case studies and interactive elements to enhance engagement, but overall, the text is deemed a valuable resource for teaching foundational and advanced accounting concepts effectively.

The 25th Edition of Fundamental Accounting Principles remains a cornerstone in accounting education, offering a comprehensive and adaptable resource that prepares students for the evolving field of accounting.

10.1 Importance of the 25th Edition in Accounting Education

The 25th Edition of Fundamental Accounting Principles serves as a cornerstone in accounting education, providing a comprehensive and updated resource for students. Its clear explanations, practical examples, and alignment with current standards ensure learners grasp essential concepts. The text’s structured approach and emphasis on critical thinking prepare future accountants to navigate the complexities of the field effectively.

10.2 Future of Accounting Principles and the Role of the 25th Edition

The 25th Edition of Fundamental Accounting Principles plays a pivotal role in shaping the future of accounting education. By incorporating modern standards, ethical considerations, and advanced topics, it equips students with the knowledge needed to adapt to evolving financial practices. The text’s emphasis on critical thinking and real-world applications prepares professionals to address future challenges in accounting with precision and integrity.